Claudia Roca

Have you ever heard of autotrading?

If you’ve started out in the world of Forex trading and investing, you must have already read that term.

Autotrading is one of the most preferred practices by traders when investing in the Forex market. This practice continues to gain followers and is for many, one of the most reliable and sustainable investment methods over time.

However, as you probably already know, there is no infallible method. Therefore, we will explain what autotrading is, how effective it is, what its benefits and disadvantages are and what factors you should consider.

With that said, let's get started:

What is autotrading?

Simply put: automated trading.

Autotrading is the use of trading software that makes trading decisions according to algorithms, standards and predefined rules.

These softwares can trade on their own and are exceptional for speeding up and optimizing decision making. They also help to do more and better analyses and market monitoring.

Autotrading Bots

Bots are one of the preferred tools for autotrading. Simply put, they are automated robots for trading on the market following specific patterns.

In other words, you can program trading bots to automate and optimize your Forex trading process. Thus, under specific and favorable conditions, your robot will intervene in the market.

With this method, you can perfect your broker management, reduce your research time and attack investment opportunities immediately.

In addition, you can also create your own trading robots according to your protocols, algorithms and parameters so that they act with fewer restrictions. Thus, you can reduce and even forget about forex commissions and trade your bots as you prefer.

But before we dive into autotrading bots...

Differences between automated trading and algorithmic trading

These two concepts are quite common within the investment landscape. However, although they are similar, they have important differences. So let's look at what each one consists of separately:

1. Automated trading

It’s the execution of trading orders by means of an automated trading software. This software can be programmed according to specific algorithms and strategies and can continue trading 24/7.

Automated trading can be executed through software such as an exchange platform. However, autotrading bots are the instrument of choice for investors.

To simplify it: automation of specific trading orders.

2. Algorithmic trading

This is the use and development of algorithms, mathematical models, data patterns and more complex formulas for more sophisticated trading strategies, high-caliber strategies that require superior skills in programming and data analysis.

Algorithmic trading, unlike algorithmic trading, is often too advanced to be implemented entirely through bots. Also, it requires manual trading executed by high-level investors.

Algorithmic models aren’t only for advanced analysis of investment markets, they also work for the development of bots and autotrading platforms.

How effective are trading bots?

It depends.

The effectiveness of trading bots is very, very subjective. It will depend on several factors, including, but not limited to:

The quality of the trading strategy and data collection methods.

The accuracy of the trading indicators.

The quality and accuracy of the market data.

The capabilities of the program.

The configuration of the bot.

A well-programmed bot can be quite profitable and give you amazing results, as long as it follows an effective trading strategy and has accurate data.

HOWEVER, neither bots nor autotrading software are infallible tools. These tools are limited to all the factors mentioned above.

For example, autotrading bots can ignore market trends if they do not conform to their pre-programmed standards. This means that they can ignore great investment opportunities.

In addition, they can ignore negative trends within the market, produced by unforeseen factors. For example: the collapse of an asset or several assets simultaneously, the failure of a bank, crises, emergencies and geopolitical events.

Therefore, even though autotrading bots are quite powerful tools, we recommend you to know the forex market well before you start investing.

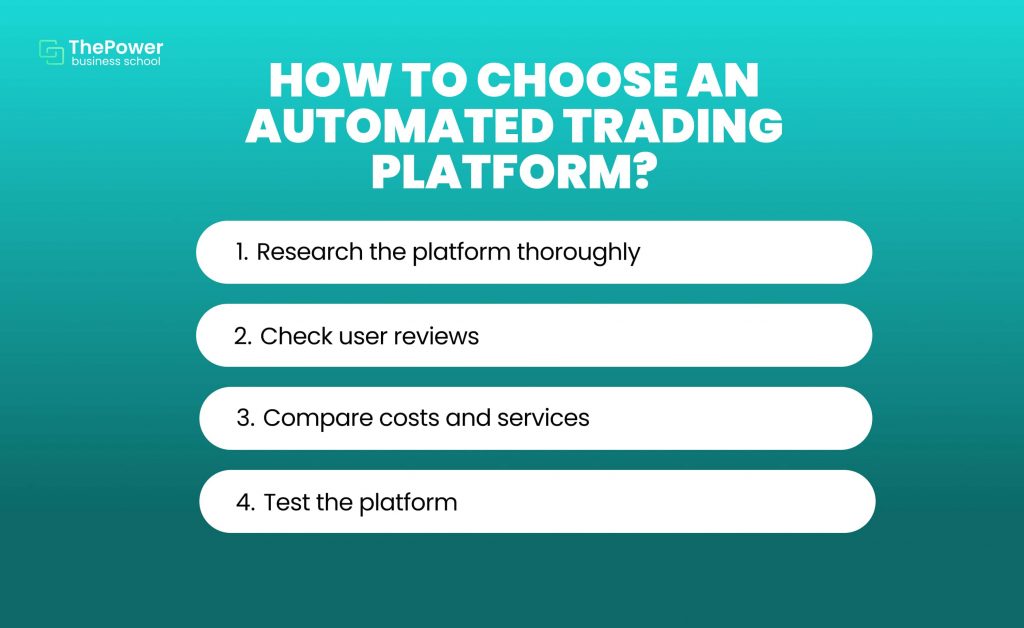

How to choose an automatic trading platform?

There are many trading platforms on the market, and many brokers offering autotrading services. However, the trading world is not free of frauds, so we will give you our best advice on how to choose the right platforms.

1. Research the platform thoroughly

Research both the company's website and its online reputation. Check their scores on review sites, review credentials and verify that the platform is regulated and certified by a financial authority.

Also, read their terms and conditions to avoid surprises in the future. And above all, to make sure that your trader is reliable, safe and can generate profits.

2. Check user reviews

When checking reviews, keep in mind that some fraudulent platforms have dedicated themselves to flooding the web with fake reviews.

Pay attention to these signs:

The user has no profile picture.

The user has only one opinion.

The review looks robotic and the spelling is almost perfect.

The review exaggerates the benefits of the platform without giving specific details.

And certainly, if a platform looks suspicious to you, trust your gut and get out. Autotrading can be incredibly profitable, but don't let your guard down.

3. Compare costs and services

Most brokers should offer programmable autotrading bots for you to configure as you prefer. However, not all platforms will offer this service.

In turn, once you have chosen your potential brokers, compare and contrast their benefits, services, plans and payment methods. Check commissions, spreads, deposit fees and withdrawal fees, among other deductions.

Make sure you choose the one that best suits your needs, gives you the most confidence and offers the best value for money.

4. Test the platform

And why would you not test the platform beforehand? You might say, but this mistake is more common than it seems.

Once you’ve chosen your autotrading platform, make sure you test each and every feature before you start investing.

Most will offer you a demo account. Make the most of this account to verify the regulation, get to know its options and functionalities and make sure you make the right decision.

Also, take a look at their security standards. Check if it has:

Two-factor authentication

Security questions.

Data encryption.

Advanced tools.

Recovery methods.

Among other features.

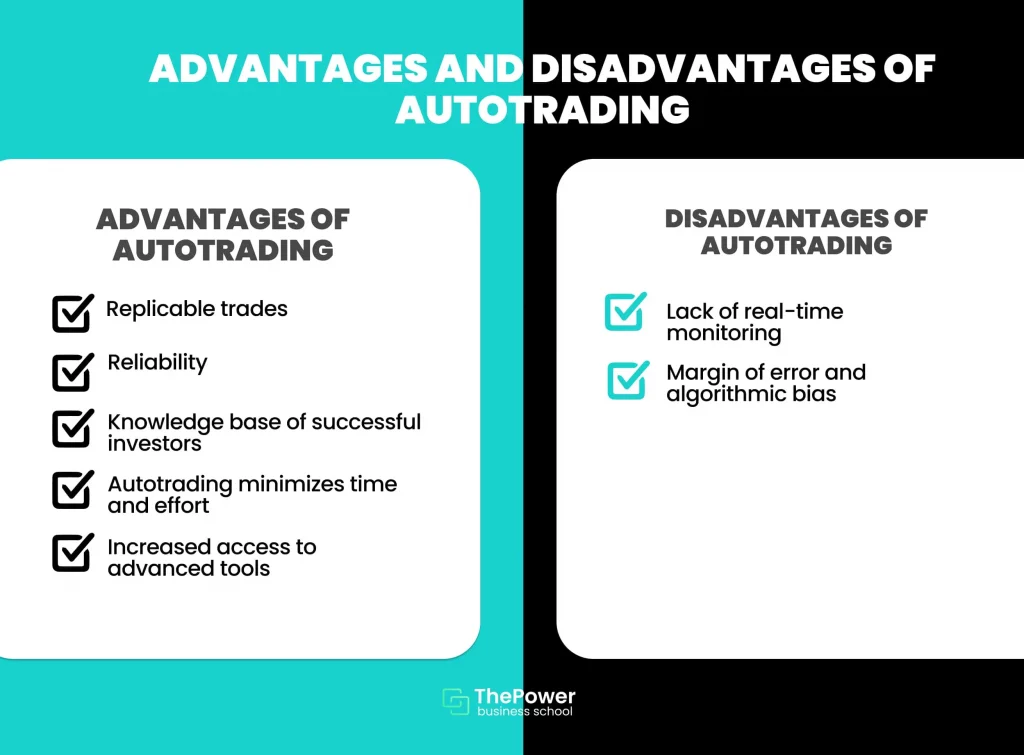

5 Advantages of autotrading

Autotrading represents a number of advantages for both beginners and experienced traders.

Let's take an in-depth look at the benefits of autotrading and why it’s the most profitable option for millions of traders:

1. Replicable trades

You can program the software or bot to take advantage of trading opportunities that match your parameters.

In other words, whenever a promising opportunity to buy an asset arises, you can take advantage of it wherever you are, no matter what.

Thus, you can replicate successful strategies of advanced traders and improve your chances of investing success.

2. Reliability

Autotrading takes emotional bias out of the equation.

By working with automated software and bots, you can execute more accurate strategies, based on more advanced statistics, trends and patterns that a human might not detect.

Thus, your investment decisions will be backed by more comprehensive and more authoritative analysis.

3. Successful investors' knowledge base

Just as you can replicate standards, variables and parameters, you can also immerse yourself in a large knowledge base to discover successful strategies and tactics.

You will learn and continue to learn from the best traders, and you can even delve into the secrets of trading and its most advanced tools.

4. Time

Trading alone requires time, a lot of time, effort and dedication. Without the right tools, analyzing global markets, market trends, news and events is time consuming and can become exhausting.

Autotrading minimizes the time and effort you have to spend analyzing and following markets and trends. Everything is done automatically according to the patterns you choose.

Although you still have to dedicate time to your autotrading tools, it doesn't compare to or come close to the time required in manual trading.

5. Greater access to advanced tools

Both investment tools and security tools. Not only will you have automated software and bots, but options to exploit their full potential and take your Forex market analysis to the next level.

Disadvantages of autotrading you need to know about

Autotrading also has certain disadvantages that are impossible to ignore if you plan to dive into the world of trading. The most important ones are:

1. Margin of error and algorithmic bias

In the financial world, there will always be margins of error and statistical bias, among many other fundamental factors, and both autotrading software and bots are limited to the protocols, standards and variables you use to program them.

Every investment opportunity that does not meet the parameters you have preset will be ignored, even if it’s a clear opportunity.

Likewise, the mathematical models of autotrading are not exempt from algorithmic and statistical biases, so there will always be a certain margin of error in your operations.

Therefore, a percentage of your automated trades will not turn out well. However, with a good investment strategy, your profits can far exceed your loss margins.

2. Lack of real-time monitoring

If you only rely on autotrading and neglect manual trading, you can ignore many excellent real-time opportunities and trends.

To catch these opportunities, you have to spend more time analyzing market trends and following news that may affect the Forex market. Therefore, even if you plan to trade using bots, we suggest you don’t abandon manual trading completely.

What do I need to start autotrading?

Technically, you don't need an academic degree to start investing, but we do suggest you start with a background, either in trading, finance, economics or data analysis.

On the other hand, if you already have a good background in finance and investment, this will be invaluable and will serve you well.

At the same time, if you have experience in data analysis, programming or software development, you will have a huge advantage, especially when performing complex analysis and programming your bots.

Whether you are starting from scratch or have a good background, we recommend you to keep training constantly. This way, your knowledge will not become obsolete and you will be able to stay at the forefront of the market and new investment technologies.

How to get started in autotrading

Trading, but before you take the big leap and start trading in the forex market, we suggest you start with the following basics:

Learn the basics and fundamentals of trading: there are no shortcuts at this level. If you want to become a specialist, you first have to start with the basics, from how the forex market works to investment strategies, before going into autotrading.

Familiarize yourself with successful strategies: study in depth how trading strategies can be automated and optimized by bots and trading platforms.

Learn how to monitor and program your autotrading bot: don't stick to the basics and discover all the functions and services of your bots. Keep in mind that your strategy can incorporate multiple bots simultaneously.

Autotrading is an amazing method for both first-time and experienced traders. If you can add autotrading to your investment strategy, your market opportunities will skyrocket.

However, remember that every investment involves some risk, so it’s essential to keep studying the market and its trends, as well as new investment strategies.

How do you plan to integrate autotrading into your strategy, and is there anything else you'd like to know? We'd love to hear all about it, so let us know in the comments and we'll be happy to answer.

Jun 26, 2023